Trading with Hurst Cycles: Foundation mini-course

This mini-course, compiled from presentations by David Hickson to audiences of professional money managers and traders in Beijing, China, and Stockholm, Sweden, introduces the basics of the Sentient Trading Approach to applying the insights we gain from a Hurst Cycles analysis.

From the basics of “what Hurst cycles are” to a detailed explanation of the trading opportunities in the Shanghai Composite Index over the course of a full 80-day cycle.

Find Out More

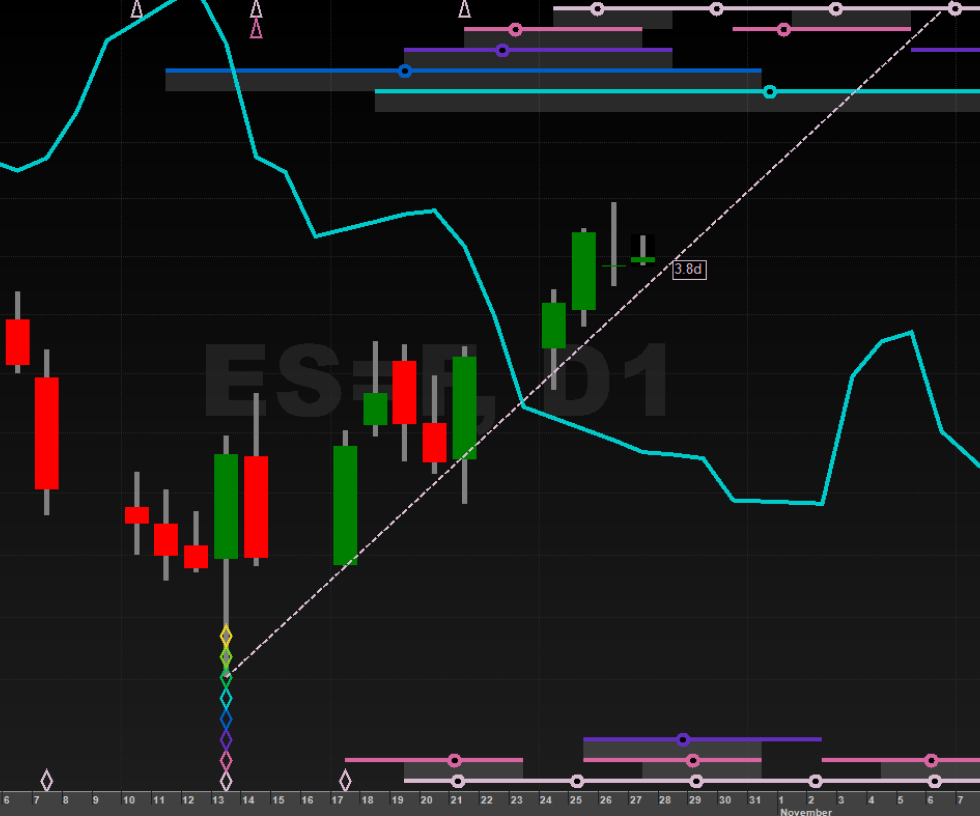

FLD Trading Strategy

The FLD Trading Strategy is a consistently reliable strategy for making trades on the basis of a Hurst Cycles analysis. The strategy is based on a sequence of interactions between price Hurst’s FLD (Future Line of Demarcation). It is a discretionary trading system with a simple underlying mechanical element, an alternative approach to Hurst’s original trading method, and one which hundreds of our students have found to be more reliable.

Find Out More

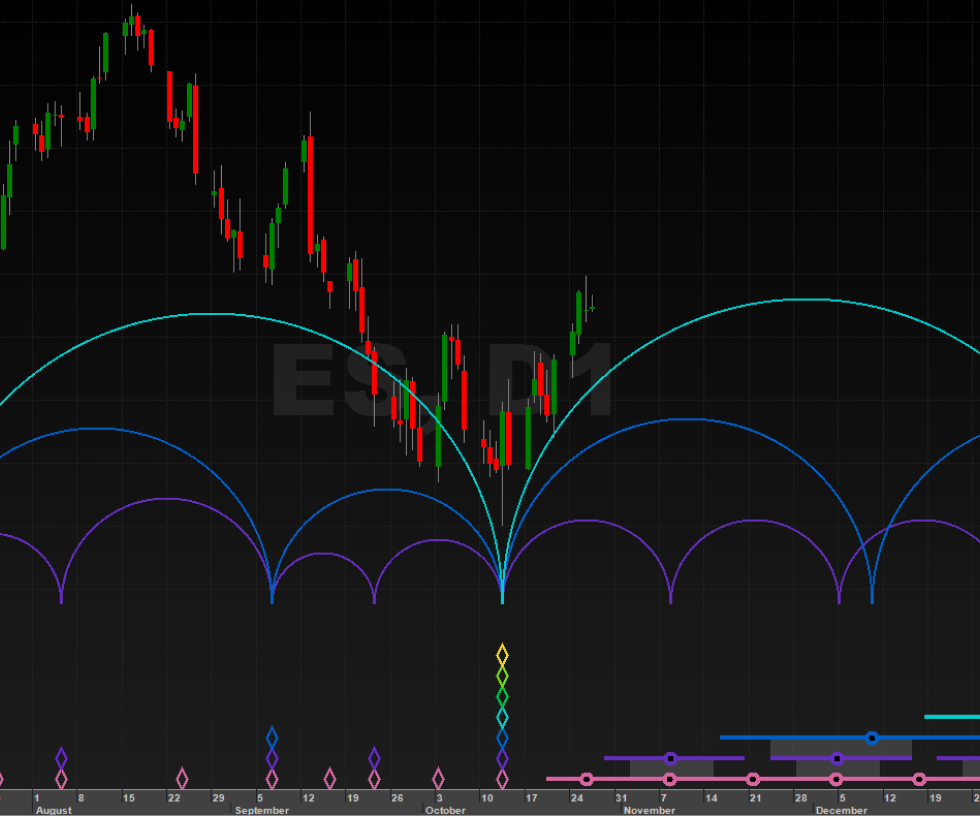

Working with Sentient Trader

Available free with software purchaseWorking with Sentient Trader is an extensive course included with the software consisting of over 20 hours of video tutorials. The course teaches you everything you need to know in order to obtain an expert Hurst cycles analysis using Sentient Trader software, how to influence that analysis as your experience grows to match your own analysis, and then use that analysis as the basis for making trading decisions.

Find Out More

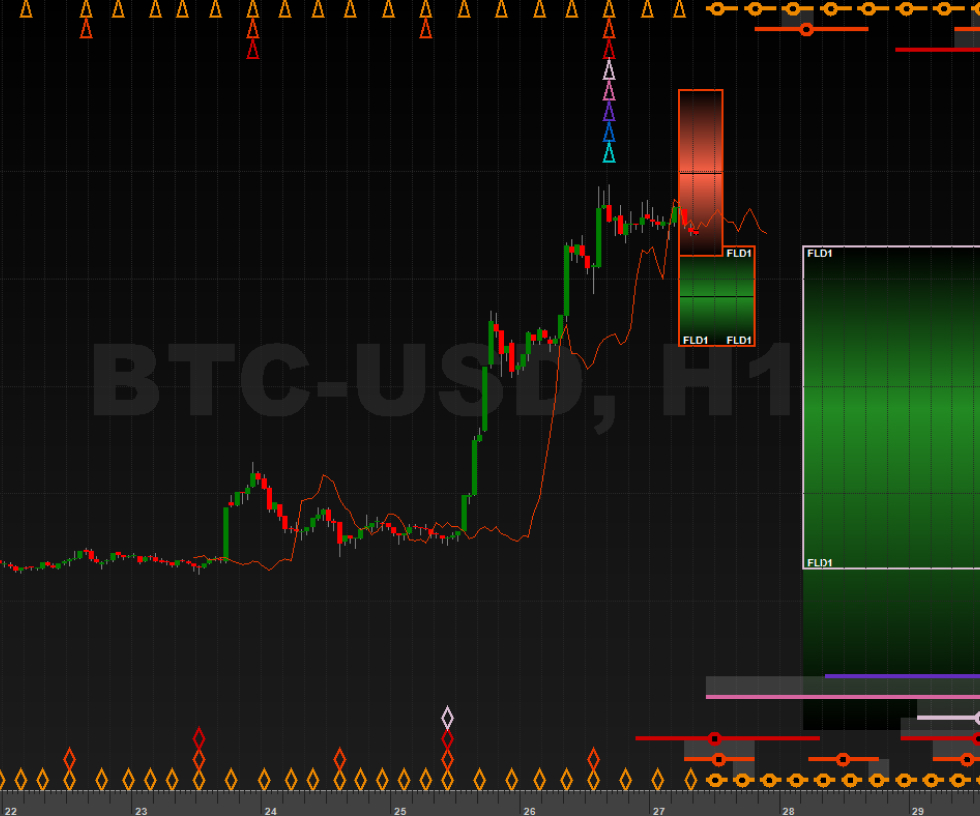

Hurst Cycles Online

Available free with software purchaseAll Hurst Cycles online (previously called Hurst Signals) subscriptions include access to this training course which consists of 11 videos that explain in detail how to use the information available in your online charts, daily email, and how to use the position size calculator included in the Hurst Cycles online dashboard.There are also important videos about identifying the best trading opportunities and the course includes an abbreviated version of the FLD trading strategy course to enable you to fully understand the strategy that underlies the trading opportunities.

Find Out More